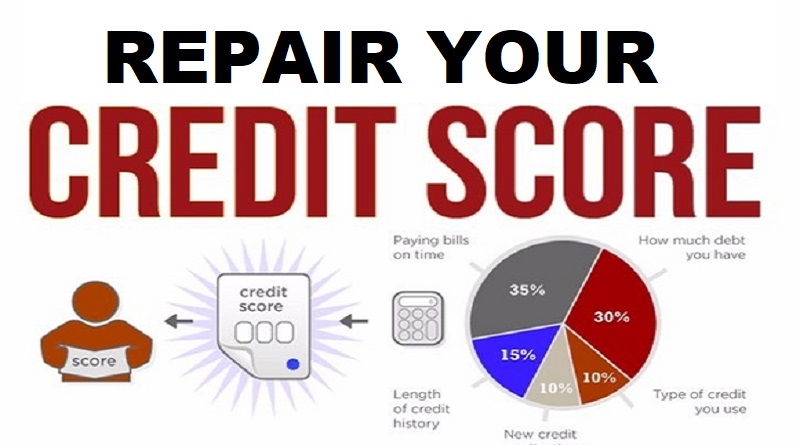

Try these tips on how to repair your credit if you’re concerned about your credit score.

Have you looked at your credit report lately and noticed that it is in need of repair? It’s said that over half of all Americans could improve their credit report, if they would only do some very simple things.

What can you do to repair credit?

Contact a Credit Repair Professional

Credit repair companies can assist you with the process of checking your credit report regularly and providing assistance by contacting credit reporting agencies about any corrections or errors. In addition, they can provide assistance for planning for repair.

When it comes to credit repair, a credit repair professional is on your side and works with you. Their objective is to help you obtain your financial goals.

How can you find a reputable credit repair company? If they are honest with you about the services they provide, the first step is to find out. The more willing they are to talk and plan to you about your credit, the more likely they’ll be there to help you with future questions.

It is also a good idea to get recommendations from others. Testimonials from other clients can give real life examples of what the credit repair company can do for you.

In all, if you feel comfortable with whom you are working, ask them about a plan and a proposed amount of time in which your credit can be repaired. The chances are the credit repair company is a good fit for you if it sounds reasonable and you are happy with the way it is presented.

Put Your Credit Card Away To Assist in your Credit Repair

When your credit is being repaired you shouldn’t cut up your credit cards or close the accounts. You may not be able to gain additional credit cards later if your credit is bad. Instead, keep them and at the very least pay the minimum amount each month.

Your payments to such a credit card will help you repair your credit score. It will also leave your credit card accounts open in case of emergency.

Don’t use the credit cards while you are trying to pay them off. Put them away; leave them at home in case you’re tempted to use them. This will prevent making the situation worse.

Tell Your Credit Repair Company About Your Plans – Create a Plan

If you’re thinking about getting a loan, your credit repair company will want to know. If your credit score is in need of more repair before you get and apply rejected, they can review your reports and set up a plan of action.

If you’re open with your credit repair company about all your needs, you’ll save yourself a lot of time and trouble.

In addition, your credit repair company should be able to provide some sort of action plan for general repair and boost of your credit score. You may be thinking about them in the future and you’ll want to be prepared if you’re not thinking about loans and credit cards now.

Contact someone at a credit repair company for assistance if you are confused about credit repair or have any concerns or questions. It’s their job to help you reach the highest credit score you can get.

How can you find a reputable credit repair company? The more willing they are to talk and plan to you about your credit, the more likely they’ll be there to help you with future questions.

When your credit is being repaired you shouldn’t cut up your credit cards or close the accounts. If your credit is bad, you may not be able to gain additional credit cards later. Don’t use the credit cards while you are trying to pay them off.