While it is true that anyone can be an investor by putting your money in a well diversified portfolio, not everyone can be a successful trader. Active trading requires far more skill and finesse to master and to make consistent money for income replacement. When a lot of the strategies that are available today are highly subjective, this is especially true.

Only by being a trader will anyone be able to generate the legendary returns that they yearn so much. And being a trader is exactly the hardest to do unless you have a proven system to follow or someone to mentor you.

Too many people have mixed being a trader for being an investor. That person then turns to exploring option trading or more or such instruments “as an investor” and completely finds that not everyone can excel in those areas.

Many people have mixed up the terms “Investor” and “Trader” to mean the same thing. Too many people have mixed being a trader for being an investor. While it is true that anyone can be an investor by putting your money in a well diversified portfolio, not everyone can be a successful trader.

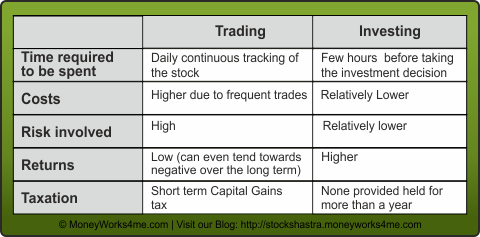

An Investor is a person who puts his money where it can potentially generate a return. He does not usually get involved in the money making process. Investors include buyers of investment real estate and buyers of funds.

Before you take the plunge into the capital markets, make sure you know what you are really into. Make sure you keep your full time job while you look for a proven system to learn if you have decided to become a trader. A proven system is something like the Star Trading System, which I have followed with great success for years.

A Trader is a person who fights in the capital markets front line personally in order to generate equity. He is the one who personally chooses the investment instrument (e.g option trading), makes an opinion on it and executes a series of trades in order to make money out of it.

Many people have mixed up the terms “Investor” and “Trader” to mean the same thing. They can’t be more wrong. It is exactly the mixing up of these 2 very important terms that led to many people starting on the wrong foot in the capital markets.