A Comprehensive Guide

Managing payroll efficiently is a critical aspect of running a small business. The right payroll software can simplify the process, ensuring accuracy, compliance, and timely payments. However, with numerous options available, choosing the best payroll software for small business can be challenging. This article will explore the features, benefits, and top solutions to help you make an informed decision.

Why Payroll Software is Essential for Small Businesses

Small businesses often face unique challenges in managing payroll. Limited resources, complex tax regulations, and the need for timely employee payments can strain operations. The best payroll software for small business offers solutions that:

- Automate Payroll Processes: From calculating wages to filing taxes, automation reduces manual effort and errors.

- Ensure Compliance: Many tools stay updated with local and federal tax laws, ensuring your business meets regulatory requirements.

- Save Time: Automated systems streamline payroll tasks, freeing up time for other business priorities.

- Enhance Accuracy: Minimize errors in calculations, tax deductions, and benefits.

- Improve Employee Satisfaction: Timely and accurate payments contribute to employee trust and morale.

Key Features to Look for in the Best Payroll Software for Small Business

When selecting payroll software, it’s essential to identify features that align with your business needs. Here are some critical functionalities to consider:

1. Ease of Use

User-friendly interfaces ensure that even non-experts can navigate the software effectively, reducing the learning curve.

2. Automated Tax Calculations

The best payroll software should handle tax calculations, including deductions, filings, and updates on tax laws.

3. Direct Deposit and Payment Options

Offering employees flexible payment options, such as direct deposits and digital wallets, enhances convenience.

4. Compliance Management

Staying compliant with local, state, and federal payroll regulations is crucial. Look for software with built-in compliance features.

5. Employee Self-Service Portals

Portals where employees can access pay stubs, tax forms, and other details reduce administrative tasks.

6. Scalability

Ensure the software can accommodate your business as it grows, handling additional employees or advanced features.

7. Integration Capabilities

Integration with accounting software, time-tracking tools, and HR systems can streamline overall operations.

8. Mobile Accessibility

Mobile-friendly payroll solutions allow business owners to manage payroll on the go, ensuring flexibility and efficiency.

Benefits of Using Payroll Software for Small Businesses

Investing in payroll software offers several advantages that go beyond simple task automation. These include:

1. Time and Cost Savings

Automating payroll processes reduces the time spent on manual calculations and minimizes the need for external payroll services.

2. Enhanced Accuracy

Human errors in payroll can lead to costly mistakes. Software solutions ensure precise calculations, minimizing discrepancies.

3. Improved Compliance

Failing to comply with tax laws can result in penalties. Payroll software helps ensure accurate tax filings and deductions.

4. Employee Satisfaction

Timely and transparent payment processes build trust and satisfaction among employees.

5. Data Security

Payroll software often includes robust security features to protect sensitive employee and business data.

Top Picks for the Best Payroll Software for Small Business

Here are some of the leading payroll software options that cater specifically to small businesses:

1. Gusto

Gusto is a popular choice for small businesses due to its comprehensive features and user-friendly interface. It offers:

- Automated payroll processing

- Tax filing and compliance

- Employee benefits management

- Time tracking and integrations with accounting software

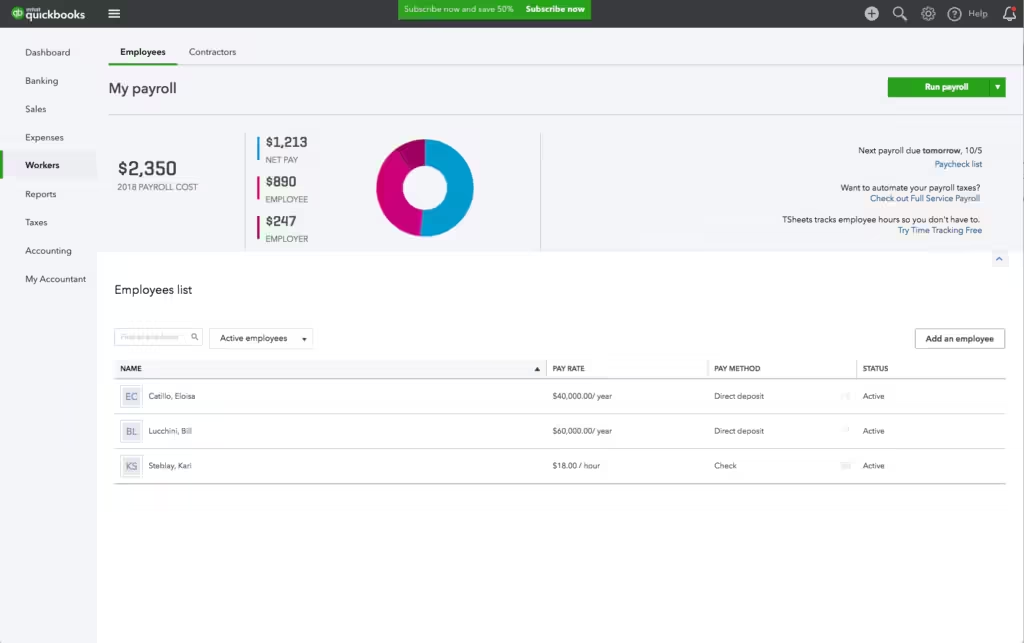

2. QuickBooks Payroll

QuickBooks Payroll is an excellent option for businesses already using QuickBooks for accounting. Key features include:

- Seamless integration with QuickBooks

- Automated tax calculations and filings

- Same-day direct deposit

- Employee benefits and 401(k) management

3. ADP Run

ADP Run is designed for small businesses and provides scalable payroll solutions. Features include:

- Payroll processing for businesses of all sizes

- Tax compliance and reporting

- HR tools and employee benefits integration

- Mobile app for payroll management on the go

4. Paychex Flex

Paychex Flex is a cloud-based solution suitable for small and growing businesses. Its features include:

- Payroll automation

- Tax compliance and reporting

- Employee benefits management

- Customizable plans to fit business needs

5. OnPay

OnPay is an affordable yet feature-rich option for small businesses. It offers:

- Unlimited payroll runs

- Automated tax filings

- Employee benefits administration

- Integration with accounting and time-tracking tools

6. Wave Payroll

Wave Payroll is a budget-friendly choice, especially for businesses already using Wave’s accounting software. Features include:

- Payroll processing and tax calculations

- Direct deposit and check printing

- Employee self-service portal

- Affordable pricing plans

7. Square Payroll

Square Payroll is ideal for small businesses and startups, especially those in retail or service industries. Key features include:

- Hourly and salaried employee payroll processing

- Tax calculations and filings

- Integration with Square’s point-of-sale system

- Affordable pricing with no hidden fees

How to Choose the Best Payroll Software for Your Small Business

Selecting the best payroll software involves evaluating your business needs, budget, and growth plans. Follow these steps to make an informed choice:

- Identify Your Requirements: List the features your business needs, such as tax compliance, integration, or mobile access.

- Set a Budget: Determine how much you’re willing to spend. Many software providers offer tiered pricing plans.

- Consider Scalability: Choose a solution that can grow with your business, accommodating more employees and features as needed.

- Read Reviews: Research user feedback to gauge reliability and customer satisfaction.

- Try Free Trials: Most payroll software offers free trials, allowing you to test functionality before committing.

Conclusion

Choosing the best payroll software for small business is an investment in efficiency, accuracy, and compliance. By automating payroll processes and providing essential tools for growth, the right software can help small businesses focus on what matters most—serving their customers and expanding their operations. Explore the options mentioned above, and select a solution that aligns with your business needs and budget to ensure smooth payroll management and employee satisfaction.