An Essential Tool for Success

In today’s fast-paced business environment, managing finances efficiently is crucial for small businesses aiming to stay competitive. The right accounting software for small business can make all the difference by simplifying bookkeeping, enhancing accuracy, and providing valuable insights for growth. This article explores the benefits, features, and popular options for accounting software tailored to small businesses.

Why Accounting Software is Essential for Small Businesses

Small businesses often operate on tight budgets and limited resources. In such scenarios, manual bookkeeping or outdated systems can lead to errors, inefficiencies, and compliance issues. Accounting software for small business offers a streamlined approach to managing finances, ensuring:

- Accuracy: Automated calculations reduce human errors.

- Efficiency: Tasks such as invoicing, expense tracking, and tax preparation are simplified.

- Compliance: Many tools help small businesses adhere to tax regulations and generate accurate reports.

- Cost Savings: By reducing the need for extensive manual labor, businesses can save money.

- Scalability: As the business grows, modern software can adapt to increasing financial complexities.

Key Features to Look for in Accounting Software for Small Business

Choosing the right accounting software requires understanding the features that align with your business needs. Here are some essential features to consider:

1. Ease of Use

Small businesses often lack the resources to hire dedicated accountants. User-friendly software with intuitive interfaces ensures that even non-experts can manage finances efficiently.

2. Invoicing and Billing

An ideal accounting tool should offer customizable invoicing, automatic payment reminders, and seamless integration with payment gateways.

3. Expense Tracking

Keeping track of expenses is vital. Look for software that allows you to categorize expenses, upload receipts, and monitor spending patterns.

4. Tax Management

Tax compliance is a significant concern for small businesses. Accounting software should facilitate tax calculations, deductions, and report generation.

5. Integration Capabilities

Integration with other tools like CRM systems, payroll software, and e-commerce platforms enhances operational efficiency.

6. Mobile Accessibility

With mobile-friendly accounting software, business owners can manage finances on the go, ensuring they stay updated at all times.

7. Security

Data security is paramount. Opt for software that offers encryption, multi-factor authentication, and regular updates to protect sensitive information.

Popular Accounting Software for Small Business

Several accounting software options cater specifically to small businesses. Here are some of the most popular choices:

1. QuickBooks

QuickBooks is a household name in the accounting software world. It offers comprehensive features such as invoicing, expense tracking, payroll management, and tax preparation. Its scalability makes it suitable for businesses of all sizes.

2. Xero

Known for its user-friendly interface, Xero is a cloud-based solution that provides tools for invoicing, inventory management, and financial reporting. It’s particularly popular among startups and small businesses.

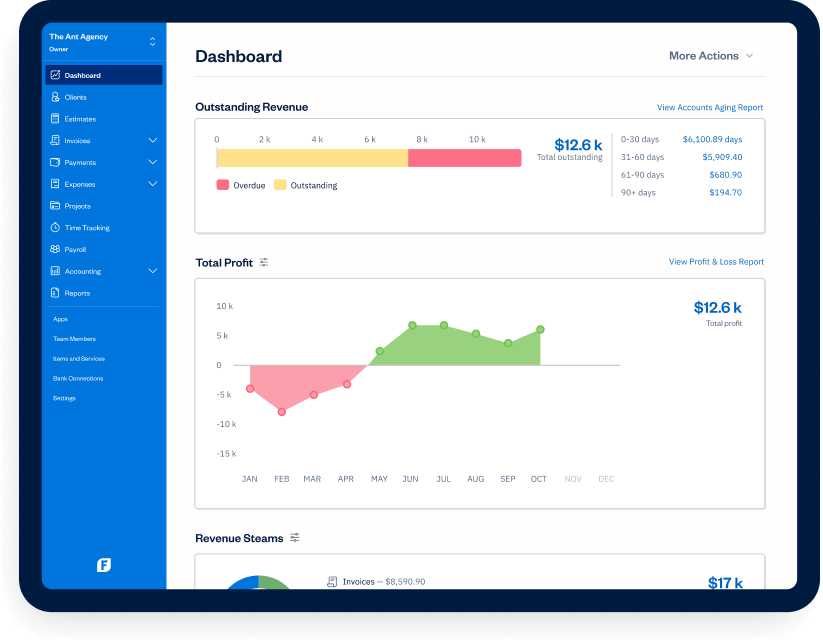

3. FreshBooks

FreshBooks is tailored for small businesses and freelancers. Its standout features include time tracking, project management, and expense organization, making it ideal for service-based industries.

4. Zoho Books

Zoho Books offers an affordable yet feature-rich solution for small businesses. It includes tools for invoicing, expense tracking, and tax management, along with seamless integration with other Zoho apps.

5. Wave

Wave is a free accounting software that caters to small businesses and freelancers. Despite being free, it offers essential features like invoicing, receipt scanning, and basic accounting tools.

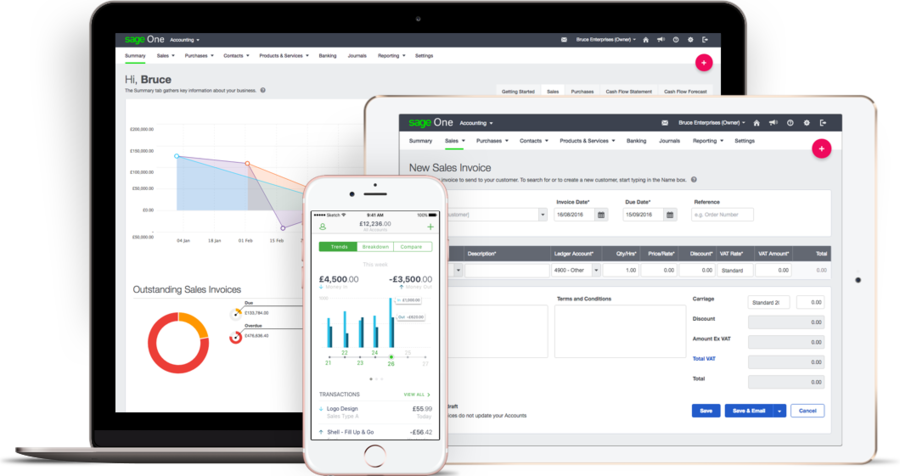

6. Sage Business Cloud Accounting

Sage provides robust accounting solutions for small businesses, focusing on automation, real-time collaboration, and cloud access.

Benefits of Using Accounting Software for Small Business

1. Time-Saving

Automated processes like invoicing, tax calculations, and bank reconciliations save significant time, allowing business owners to focus on core activities.

2. Improved Decision-Making

Real-time financial data and detailed reports enable informed decision-making, helping businesses identify growth opportunities and potential risks.

3. Better Cash Flow Management

With features like cash flow tracking and payment reminders, businesses can maintain healthy finances and avoid cash shortages.

4. Enhanced Collaboration

Cloud-based accounting software allows multiple users, including accountants and business owners, to collaborate effectively from different locations.

5. Cost-Effectiveness

Many accounting software solutions are subscription-based, allowing small businesses to access powerful tools without significant upfront costs.

How to Choose the Right Accounting Software for Your Small Business

Selecting the right accounting software involves assessing your specific business needs and comparing available options. Here are some tips:

- Identify Your Requirements: Determine which features are non-negotiable for your business, such as payroll integration or inventory management.

- Consider Your Budget: Look for software that offers the best value for money. Free options like Wave can be an excellent starting point for very small businesses.

- Check for Scalability: Ensure the software can grow with your business, accommodating more users or advanced features as needed.

- Read Reviews: Research user reviews and testimonials to gauge software performance and reliability.

- Take Advantage of Free Trials: Many providers offer free trials, allowing you to test their software before committing.

Conclusion

Accounting software for small business is no longer a luxury but a necessity. By automating financial tasks, enhancing accuracy, and providing valuable insights, these tools empower small business owners to focus on what they do best—growing their business. Whether you’re a freelancer or a growing enterprise, there’s an accounting software solution tailored to your needs. Take the time to evaluate your options, and invest in a tool that will simplify your financial management and set your business on a path to success.