Keep it Separate! You should not track personal finances, investments, and details not specifically related to your business in your QuickBooks company file. If using an accountant or tax preparation service, mixing of personal and business funds makes tax preparation harder and more expensive in some cases.

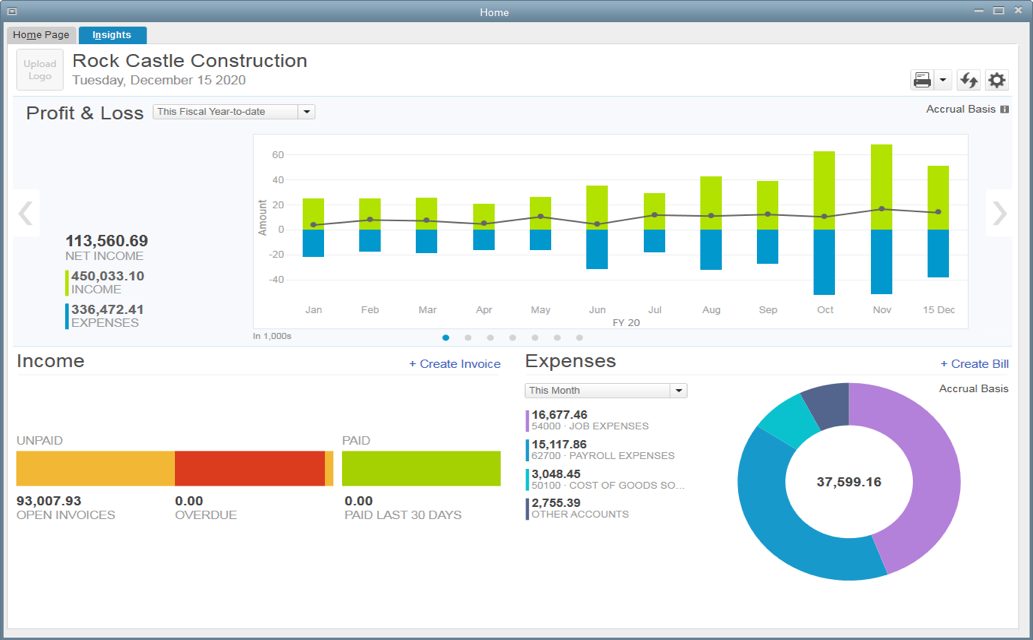

If you assign account numbers for each account, you will have to memorize the numbers for fast data entry. Utilize Reports QuickBooks has many reports you can run for daily management of your business. When you choose to display a report such as the Profit and Loss statement, you are able to drill down from each account to obtain the source of the amount in the report. Assets include what you have and what people owe you money, such as your bank account balance, inventory owned, accounts receivable, and fixed assets such as equipment and furniture. Other reports include detailed and summary sales reports, sales tax reports, inventory reports, vendor reports, sales tax reports, payroll reports, and many more.

When you choose to display a report such as the Profit and Loss statement, you are able to drill down from each account to obtain the source of the amount in the report. Assets include what you have and what people owe you money, such as your bank account balance, inventory owned, accounts receivable, and fixed assets such as equipment and furniture. Other reports include detailed and summary sales reports, sales tax reports, inventory reports, vendor reports, sales tax reports, payroll reports, and many more.

The system also offers sample business templates that already have accounts set up for you. Too many accounts result in messy reports that are hard to analyze and read. If you assign account numbers for each account, you will have to memorize the numbers for fast data entry.

Create a Professional Image QuickBooks also has other features that allow you to customize forms such as invoices, statements, and purchase orders you want to send to your vendors and customers. It will allow you to generate mailing labels and email messages to your existing customers and vendors that are setup in QuickBooks. You can also print checks on preprinted business forms.

An accounting degree is not required to enter weekly and daily tasks in QuickBooks. QuickBooks is an easy to use accounting software program that allows business owners to manage their business more profitably.

What this means is you record your expenses when you write the check or charge your credit card, and you record your sales or income when you take the money to the bank and deposit it into your account. This is the easiest way to account for your transactions. Some businesses are required by the IRS to report on the accrual basis.

QuickBooks is a great accounting program for home-based businesses to track their income and expenses. You do not need an accounting background to be able to generate reports such as a Profit and Loss and Balance Sheet needed for tax preparation and managing your business.

Online banking is available with QuickBooks, which enables you to pay your bills electronically and reconcile your bank accounts monthly. This is essential to make sure you capture all business deductions to minimize your end of year tax liability.