The foreign exchange market is a worldwide market and according to some estimates is almost as big as thirty times the turnover of the US Equity markets. Forex is the commonly used term for foreign exchange. As a person who wants to invest in the forex market, one should understand the basics of how this currency market operates.

Foreign exchange is the buying and the selling of foreign exchange in pairs of currencies. For

This trade constitutes about 5% of all currency transactions,

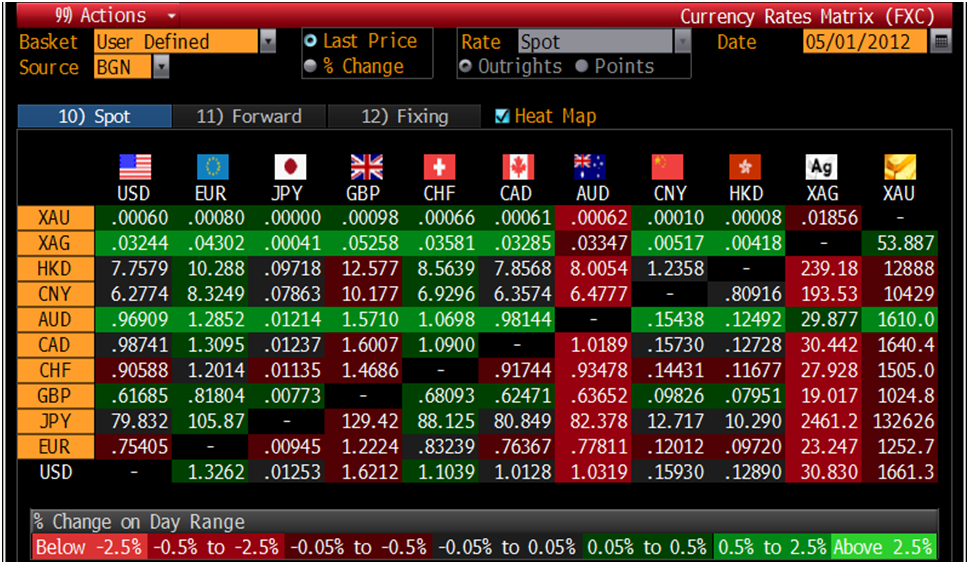

Those who are involved in the free trade know that almost 85% of the trading is done in only US Dollar, Japanese Yen, Euro, British Pound, Swiss Franc, Canadian Dollar

Being a truly 24/7 market, the currency trading markets open in the financial centers of Sydney, Tokyo, London and New York in that sequence. Investors and speculators alike respond to the ever-changing situations and can buy and sell simultaneously the currencies. Many operate in two or more currency markets using arbitrage to gain profits (buying in one market and selling in another market or vice versa to take advantage of the prices and book profits).

While dealing in forex, one should have a margin account. Quite simply put if you have US$ 1,000 and have a forex margin account which leverages 100:1 then you can buy US$ 100,000 since you only need 1% of the US$ 100,000 or US$ 1,000. Therefore it means that with a margin account you have US$ 100,000 worth of real purchasing power in your hand.

Since the foreign currency market is fluctuating on a continuous basis, one should be able to understand the factors that affect this currency market. These two tools of

The foreign exchange market is a worldwide market and according to some estimates is almost as big as thirty times the turnover of the US Equity markets. As a person who wants to invest in the forex market, one should understand the basics of how this currency market operates. Many operate in two or more currency markets using arbitrage to gain profits (buying in one market and selling in another market or vice versa to take advantage of the prices and book profits).

Since the foreign currency market is fluctuating on a continuous basis, one should be able to understand the factors that affect this currency market. These two tools of trade are used in a variety of other markets such as equity markets, stock markets, mutual funds markets etc.