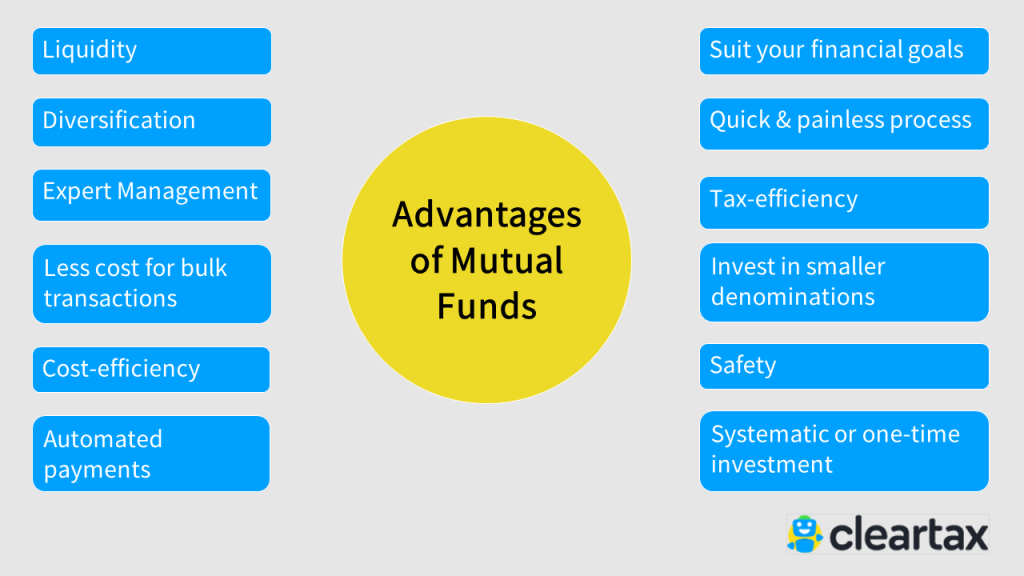

To support new business especially in real estate, construction, entertainment you need a back up of private investor funding. You also need to have fair to excellent credit score to obtain private investor funding. There are many known names in this business.

Angels are thought of as individuals, the actual entity that provides the funding may be a trust, business, investment fund, etc

The bottom line: even if you don’t have the money right now to invest, you can certainly find the money, whether you have to pool your money with others or obtain private investor funding from an institution. Don’t let a lack of funds hold you back; do your research, formulate a plan, and start investing and getting rich from the market.

To support new business especially in real estate, construction, entertainment you need a back up of private investor funding. Private investor funding basically lends you money against your private trust deeds, excellent business idea, and liquid rate of the land or business. Venture capital and private investor funding work hand in hand for somebody who is setting up a new business.

. Private investor funding basically lends you money against your private trust deeds, excellent business idea, and liquid rate of the land or business.

Private investors are now seeking to organize themselves, making a bigger entity than just working individually to receive small gains. Once they pool in their investments and form a network of private investors they can get bigger returns and this idea is very alluring.

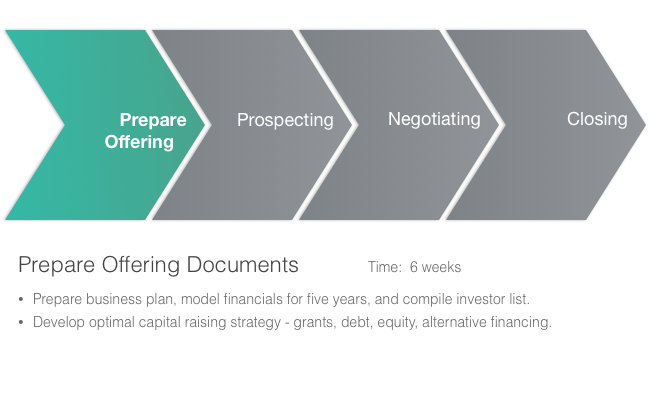

A private investor funding is done by reviewing the business plan. The funding institute or the individual then have an investment proposal that is both sufficiently attractive and sensible to investors. This funding can be raised by a group of investors.

This kind of funding comes with a high risk and therefore they demand a high return on investment. Individuals providing private investor funding have an exit strategy planned so that the original investment bring them more than five times the return in 3 to 5 years. The exit strategy could include IPOs or acquisition.

Not just in the US but this type of funding can support new businesses in developing countries too. Venture capital and private investor funding work hand in hand for somebody who is setting up a new business. Companies use these funds to increase its R&D, sales and marketing efforts.